Did you know that completing a TPS/TVQ declaration can be a daunting task for many business owners in Canada? In fact, the intricate process can often leave entrepreneurs feeling overwhelmed and confused.

But fear not! In this quick guide, I will provide you with invaluable tips and step-by-step instructions to make filling out your TPS/TVQ declaration a breeze. Whether you’re new to the process or simply looking for a more efficient method, this guide has got you covered. So let’s dive in and unlock the secrets to seamless TPS/TVQ declaration completion!

Key Takeaways:

- Completing a TPS/TVQ declaration can be complex and overwhelming for business owners in Canada.

- This quick guide provides essential tips and step-by-step instructions to simplify the process.

- Whether you’re using online methods or paper forms, this guide will help you accurately and efficiently fill out your TPS/TVQ declaration.

- Understanding the different types of declarations and methods available is crucial for choosing the right approach for your business.

- Properly calculating your TPS/TVQ taxes involves recording total sales, calculating net tax, and accounting for other credits and debits.

Types of TPS/TVQ Declarations and Methods

When it comes to filing your TPS/TVQ declarations, there are various options available to suit your business needs. Understanding the different types of declarations and methods can help you choose the most efficient approach for your accounting process.

Online Filing

One method is filing your TPS/TVQ declaration online. This offers convenience and speed, allowing you to submit your declaration electronically. Online filing is ideal for businesses looking for a quick and efficient way to complete their TPS/TVQ declarations. It also provides the advantage of electronic record-keeping, making it easier to access and manage your financial information.

Paper Forms

Alternatively, you can opt for filling out paper forms for your TPS/TVQ declaration. This traditional method involves manually completing and mailing the necessary forms to the relevant tax authorities. While paper forms may take longer to process compared to online filing, they provide a physical record of your declaration and can be a preferred choice for those who prefer a paper trail.

Streamlined Accounting Methods

In addition to choosing between online filing and paper forms, you may also be eligible for streamlined accounting methods. These methods are designed to simplify your accounting process by providing specific guidelines and requirements for calculating and reporting your TPS/TVQ taxes. Streamlined accounting methods can save you time and effort by offering a straightforward approach tailored to your business needs.

By understanding the different types of TPS/TVQ declarations and methods available, you can select the most suitable option to ensure accurate and efficient completion of your declaration form.

Calculating Your TPS/TVQ Taxes

The calculation of your TPS/TVQ taxes involves several steps. To ensure an accurate calculation and avoid any discrepancies in your declaration, it’s important to follow these steps:

- Inscribe your total sales and other revenues. This includes all income generated from your business activities.

- Calculate your net tax. To do this, subtract any applicable credits from your total tax owed. These credits may include input tax credits or other deductions that reduce your taxable amount.

- Account for other credits and debits. If there are any additional credits or debits that impact your TPS/TVQ taxes, make sure to accurately record them in your declaration.

- Enter the amount of TPS/TVQ refund requested or the amount owed, if applicable. Depending on your business situation, you may be eligible for a refund or have an outstanding balance to remit.

By carefully completing these calculations and recording the necessary information, you can ensure the accurate reporting of your TPS/TVQ taxes. It’s crucial to maintain proper documentation and comply with tax regulations to avoid penalties or discrepancies in your financial records.

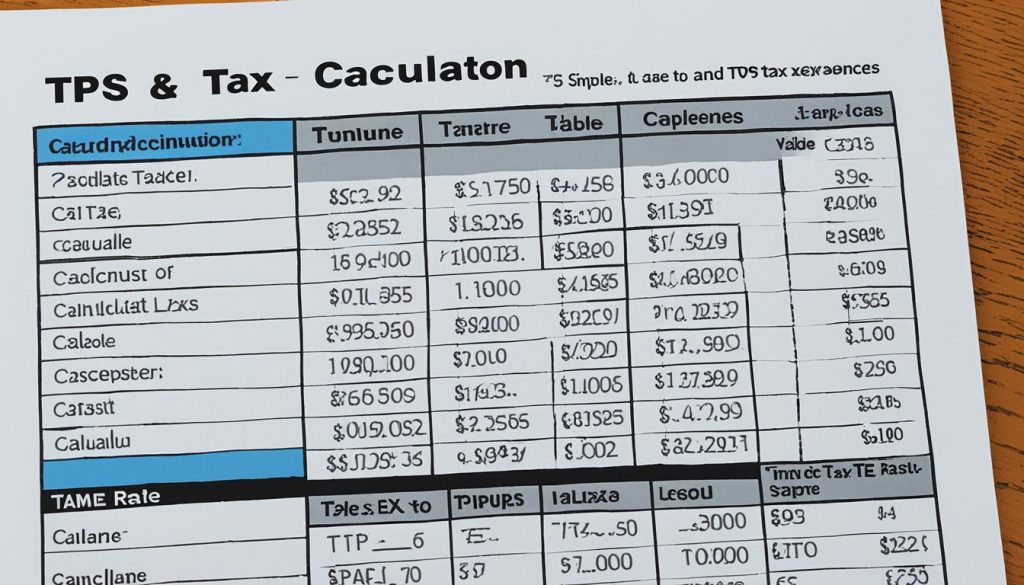

For a visual representation of the TPS/TVQ tax calculation process, refer to the table below:

Choose a center position for the image to maintain visual appeal and relevance to the topic of the article.

Filling Out the TPS/TVQ Declaration Form

When it comes to filling out the TPS/TVQ declaration form, accuracy is key. It’s essential to provide all the necessary information about your business, including personal details, sales figures, and any applicable annexes. By completing each section of the form, including annexes A, B, and C if required, you can ensure that your declaration is complete and accurate.

Providing Business Information

The first step in filling out the TPS/TVQ declaration form is to provide your business’s personal information. This includes details such as your business name, address, contact information, and business number. Ensure that this information is accurate, as any errors or omissions may lead to delays or potential penalties.

Filling Out Annex A, Annex B, and Annex C

Depending on your business activities, you may need to fill out additional annexes along with the main declaration form. Annex A is for reporting specific activities, such as investment plans or brokerage services. Annex B is used to declare sales made to non-residents of Canada. Annex C is for reporting goods and services tax/harmonized sales tax (GST/HST) amounts collected or that became collectible for each participating province or territory, if applicable.

Make sure to carefully review the instructions for each annex and fill out the required information accurately. Incorrectly completed annexes can lead to incorrect tax calculations or delays in processing your declaration.

Completing the TPS/TVQ declaration form may seem daunting at first, but by following the instructions provided and double-checking your information, you can ensure that your declaration is accurate and in compliance with tax regulations. Taking the time to fill out the form correctly will help prevent any potential issues and allow for a smooth tax filing process.

| Annex | Description |

|---|---|

| Annex A | For reporting specific activities |

| Annex B | For declaring sales made to non-residents of Canada |

| Annex C | For reporting GST/HST amounts collected or that became collectible for each participating province or territory |

Submitting Your TPS/TVQ Declaration

Now that you have successfully filled out your TPS/TVQ declaration, it’s time to submit it before the deadline. Follow the steps below to ensure a smooth submission process:

- Check the Deadline: Before submitting your declaration, make sure you are aware of the deadline. The deadline for submitting your TPS/TVQ declaration is based on your reporting period. Missing the deadline can result in penalties and interest charges, so mark it in your calendar to stay on track.

- Electronic Filing: If you prefer a faster and more convenient method, consider using the electronic filing system. The electronic method allows you to submit your declaration online, saving time and effort. To do this, you will need to use the appropriate software or service compatible with the Revenu Québec system.

- Mail Submission: If you prefer to submit your declaration by mail, ensure you have printed and signed a copy of the completed form. Enclose all required supporting documents, such as annexes, if applicable. Address the envelope correctly, including the designated department and address provided by Revenu Québec.

Remember, regardless of the submission method you choose, it is crucial to submit your TPS/TVQ declaration on time to avoid any unnecessary penalties or interest charges.

For additional information and resources on submitting your TPS/TVQ declaration, visit the official Revenu Québec website or contact their customer service for assistance.

| Submission Method | Pros | Cons |

|---|---|---|

| Electronic Filing |

|

|

| Mail Submission |

|

|

Additional Resources and Support

If you need further assistance with filling out your TPS/TVQ declaration, there are additional resources available to help you. One helpful resource is accessing examples of completed declarations. These examples can give you a clear idea of how to properly fill out each section of the form and ensure accuracy in your own declaration.

Another valuable resource is tutorials that provide a step-by-step guide on completing the TPS/TVQ declaration. These tutorials break down the form into manageable sections, explaining each part in detail and walking you through the process. By following these tutorials, you can ensure compliance with TPS/TVQ regulations and avoid any mistakes in your declaration.

Remember, utilizing these additional resources is crucial in accurately filling out your TPS/TVQ declaration. They provide valuable guidance and support, helping you navigate the complexities of the form and ensuring you meet all the necessary requirements. Take advantage of the example declarations and tutorials to streamline your declaration process and submit your form with confidence.